The NYC Mortgage Recording Tax (MRT) is 1.8% for loans below $500k and 1.925% for loans of $500k or more. The MRT is the largest buyer closing cost in NYC. How much Mortgage Recording Tax you pay is based on the size of your loan as opposed to the purchase price. The MRT does not apply to co-op apartments.

The Mortgage Recording Tax Rates in NYC are technically 2.05% for loan sizes below $500k and 2.175% for loan sizes of $500k or more, but the buyer’s lender typically pays 0.25% of the MRT.

Therefore, the effective Mortgage Recording Tax rates you pay as a buyer in NYC are 1.8% for loans under $500k and 1.925% for loans of $500k or more. Commercial properties and four or more family houses have a higher Mortgage Recording Tax rate of 2.8%.

You can reduce the amount of the Mortgage Recording Tax by negotiating a Purchase CEMA loan with the seller. See below for more information on a Purchase CEMA works in NYC real estate.

Fortunately, the Mortgage Recording Tax is not applicable to co-op apartments in NYC. This is because the tax only applies to mortgage debt on real property, and co-ops are not technically considered to be ‘real property.’

The fact that buyers of co-ops do not have to pay the Mortgage Recording Tax is one of the main reasons why buyer closing costs are significantly higher for condos compared to co-ops in NYC.

Table of Contents:

The Mortgage Recording Tax in NYC is a transaction tax levied by New York State and New York City on all new mortgages funded.

The mortgage recording tax in NYC is a percentage of your loan size, and applies to new mortgages for acquisitions as well as refinancings. The mortgage recording tax in NYC only applies to mortgage debt on real property, meaning condos, townhouses, multi-family properties, etc.

Co-ops Are Not Real Property

The mortgage recording tax is not applicable for loans backed by co-op apartment shares since coops are not considered to be real property.

Furthermore, the Mortgage Recording Tax only applies if the purchaser will be utilizing financing.

No tax is due for all cash purchases made without a mortgage.

Get a 2% Rebate When You Buy

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How Much Is the Mortgage Recording Tax in NYC?

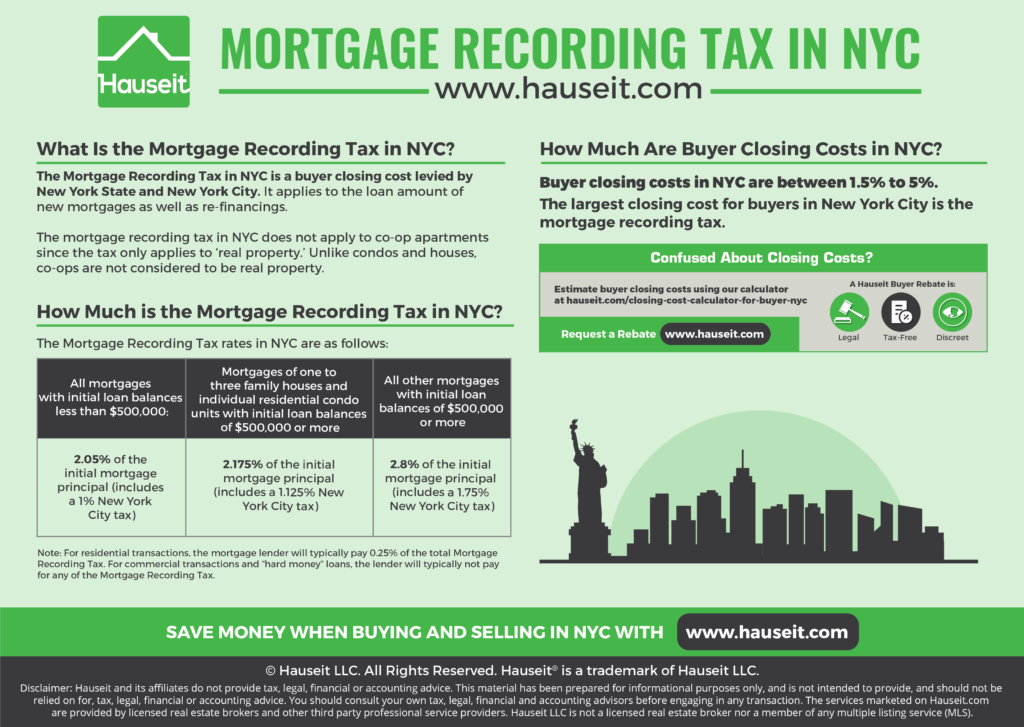

The Mortgage Recording Tax in NYC varies depending on the size and classification of the mortgage, and is composed of both a New York City tax as well as New York State’s Basic Tax, Special Additional Tax and Additional Tax. The rates are as follows:

All mortgages with initial loan balances less than $500,000

-

2.05% of the initial mortgage principal (includes a 1% New York City tax)

Mortgages of one to three family houses and individual residential condo units with initial loan balances of $500,000 or more

-

2.175% of the initial mortgage principal (includes a 1.125% New York City tax)

All other mortgages with initial loan balances of $500,000 or more

-

2.8% of the initial mortgage principal (includes a 1.75% New York City tax)

The Mortgage Recording Tax is not unique to NYC; however, the Mortgage Recording Tax in NYC is dramatically higher than the tax rates in other counties in New York. For example, the total Mortgage Recording Tax in Westchester County, NY is only 1.3%.

The Mortgage Recording Tax in other New York counties are typically 1% or 1.25%, though you will see a few counties such as Ulster and Madison charge as low as 0.75%. Check out the tax tables yourself on Form MT-15, otherwise known as the Mortgage Recording Tax Return.

Mortgage Lender Contribution

For residential transactions, the mortgage lender will typically pay 0.25% of the total Mortgage Recording Tax.

For commercial transactions and “hard money” loans, the lender will typically not pay for any of the Mortgage Recording Tax.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Who Pays the Mortgage Recording Tax in NYC?

The Mortgage Recording Tax is typically paid by the buyer in a New York City real estate transaction.

It is important to remember that this tax is only applicable for purchases of real property such as condos vs co ops. If you are buying a coop in NYC, then you’re in luck.

Buyers of co op apartments are not required to pay any Mortgage Recording Tax whatsoever as their acquisition loan is not technically a mortgage. A mortgage must be secured by real property, whereas a co-op apartment loan is secured by a stock certificate and proprietary lease.

Not All Closing Costs Are Negotiable

Unlike other closing costs in NYC such as transfer taxes in a sponsor unit sale or the Mansion Tax which may be negotiable, it is very uncommon to see the Mortgage Recording Tax being paid by anyone but the buyer.

That’s because the amount of the tax will depend entirely on the buyer’s finances and decision on how much to borrow.

If the buyer purchased the apartment all cash, there wouldn’t be any Mortgage Recording Tax to speak of.

As a result, it doesn’t really make sense to ask the seller to cover the Mortgage Recording Tax since the amount of the tax is entirely dependent on the financing decisions of the buyer.

A great way to minimize the impact of the Mortgage Recording Tax is to negotiate a purchase CEMA loan with the seller.

For a purchase CEMA loan to happen, the seller needs to have a reasonable amount of mortgage principal remaining on their home. If so, the seller’s bank can assign the seller’s remaining loan balance to the buyer’s bank. As a result, the buyer would only need to pay the Mortgage Recording Tax in NYC on any new loan amount on top of the seller’s mortgage.

The Seller Must Agree to a Purchase CEMA

Of course, for this to happen the seller needs to provide consent. This price of this consent may be heavy, as a savvy seller may ask you to split the cost savings with them.

However, you can make sure the seller knows that they will also be saving via reduced New York State transfer taxes which are normally 0.4% of the sale price.

Purchase CEMA loans can also be utilized for a refinancing of an existing home.

In fact, lenders will be more willing to do a purchase CEMA if they will be holding onto the mortgage. Essentially, they are usually more than happy to do a purchase CEMA and assign the new loan to themselves.

Purchase CEMA transactions are highly complex and require the negotiating skills and experience of a real estate attorney familiar with such transactions, as well as a buyer’s broker who has done these types of deals before.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

How Is the Mortgage Recording Tax Filed?

The New York City Register’s Office collects this tax for Manhattan, Brooklyn, Queens and the Bronx. The Richmond County Clerk collects this tax for Staten Island.

All property documents for Manhattan, Brooklyn, Queens and the Bronx are recorded online using ACRIS, which is NYC’s online database of public property records.

Documents for Staten Island must be recorded in person at the Richmond County Clerk’s Office.

The legal authority for collecting the NYC Mortgage Recording Tax comes from Title 11, Chapter 26, Administrative Code and Tax Law Section 253-a.

MT-15, otherwise known as the Mortgage Recording Tax Return, is a New York State Department of Finance form that needs to be properly filled out and filed in order for your mortgage to be recorded.

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.