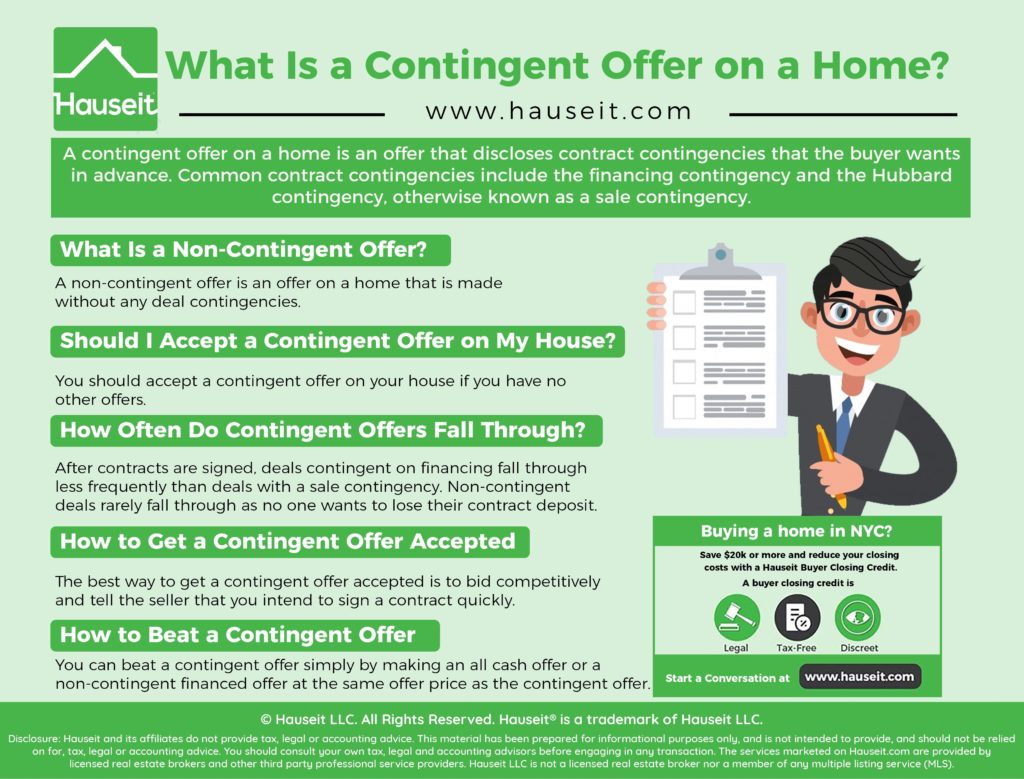

A contingent offer on a home is an offer that discloses contract contingencies that the buyer wants in advance. Common contract contingencies include the financing contingency and the Hubbard contingency, otherwise known as a sale contingency.

Table of Contents:

A non-contingent offer is an offer on a home that is made without any deal contingencies. A non-contingent offer can be an all cash offer, or it can be a financed offer that simply doesn’t have a mortgage contingency or any other contingencies.

A financed offer that is non-contingent can be slightly less risky for the buyer because he or she could forfeit the earnest money check if they can’t get a bank to lend them the money. However, given that the typical contract deposit is 10% of the contract purchase price, this can be hard to stomach.

There are no protections for the buyer if the deal goes into contract and the buyer isn’t able to secure financing.

A financed offer that is non-contingent is usually made by buyers who know they can find the money to purchase the property all cash if their financing doesn’t materialize.

For example, a buyer might have enough assets to purchase the property all cash, but would prefer to utilize a mortgage. Or perhaps a buyer has rich relatives who can lend them money quickly should their financing fall through.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

You should accept a contingent offer on your house if you have no other offers. However, if you have competing offers, you should encourage contingent bidders to sweeten their terms by either increasing their offer level and/or removing their contingencies.

Better yet, you can accept multiple offers and even send out multiple contracts for negotiation.

Remember that nothing is binding until contracts have been signed, and since the seller is the last to act, you won’t be bound to an accepted offer until you choose to counter-sign a contract.

Of course, if you have a competing, non-contingent offer that is substantially better than another contingent offer, you may want to just accept the non-contingent offer outright and not waste time with the contingent offer.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Contingent offers fall through as often as non-contingent offers because offers generally aren’t binding until formal contracts have been signed. As a result, buyers can withdraw an offer on a house regardless of whether they asked for a contract contingency or not.

Once a deal is in contract, it’s very unlikely to see an offer fall through even if the buyer has a financing contingency.

That’s because the financing contingency only gives the buyer a limited period of time, say 30-45 days, to back out of the contract if they can’t secure a mortgage commitment letter from a bank.

However, it can take longer than that to secure a mortgage commitment letter, and the buyer will have to make the difficult decision of cancelling their deal or taking a risk and automatically waiving the financing contingency by not cancelling.

In practice, most buyers will waive the financing contingency at that point because they want to buy the home after all!

Furthermore, even if the buyer forfeits their financing contingency by not cancelling, a buyer is very unlikely to default on the contract because no one wants to lose their contract deposit. As a result, buyers will usually find some way to get the money, either through a relative or a hard money loan if their primary financing falls through.

Offers with Hubbard or sale contingencies are much more likely to fall through. That’s because the deal is contingent on the buyer being able to secure another buyer for their own home. There are often too many moving parts to a deal with a Hubbard Contingency, and as a result these deals are much more likely to come apart at the seams.

The best way to get a contingent offer accepted is to bid competitively and tell the seller that you intend to sign a contract quickly. If a home is priced in line with the market and there are competing offers, then the best way to get a contingent offer accepted is to submit an offer at the listing price and say you intend to sign a contract within five business days.

If you don’t do this, perhaps because you’ve read our guide on how to make a winning lowball offer on a NYC apartment, then the seller will be hesitant to accept your offer especially if there are competing offers.

In a normal market where supply and demand is relatively balanced, a seller will be hesitant to accept a low offer especially if it is contingent. A seller would much rather hold out for a non-contingent offer instead. This is why it’s important to show that you’re quite serious if you’re going to ask for a contingency.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

You can beat a contingent offer simply by making an all cash offer or a non-contingent financed offer at the same offer price as the contingent offer. All things being equal, your offer will be much more attractive to the seller and your offer will be accepted vs the contingent offer.

If you have a great buyer’s agent, he or she may be able to find out from the listing agent just how credible the competing offers are. If the competing offer is contingent on financing and seems rather shaky, then you might be able to get away with offering less and still getting your offer accepted.

This is a typical clause you’ll see at the beginning of a Hubbard Contingency. Read our article on what is a Hubbard Contingency for NYC real estate transactions to learn and see more.

Typical Clause in a Hubbard Contingency

This Contract is contingent upon Buyer obtaining a non-contingent contract for the sale of Buyer’s existing home, subject to and in accordance with the further provisions of this Rider.

For the purposes of this Rider, a “non-contingent contract” for the sale of Buyer’s existing home shall mean a contract that may not be unilaterally terminated by the purchaser as a result of any condition to be satisfied by the purchaser.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.