Your loved one has passed away and has left behind property. What do you do next? How do estate sales work?

We’ll teach you how to have an estate sale in NYC in this article, from the first step of getting a death certificate to minimizing closing costs when property is sold.

Table of Contents:

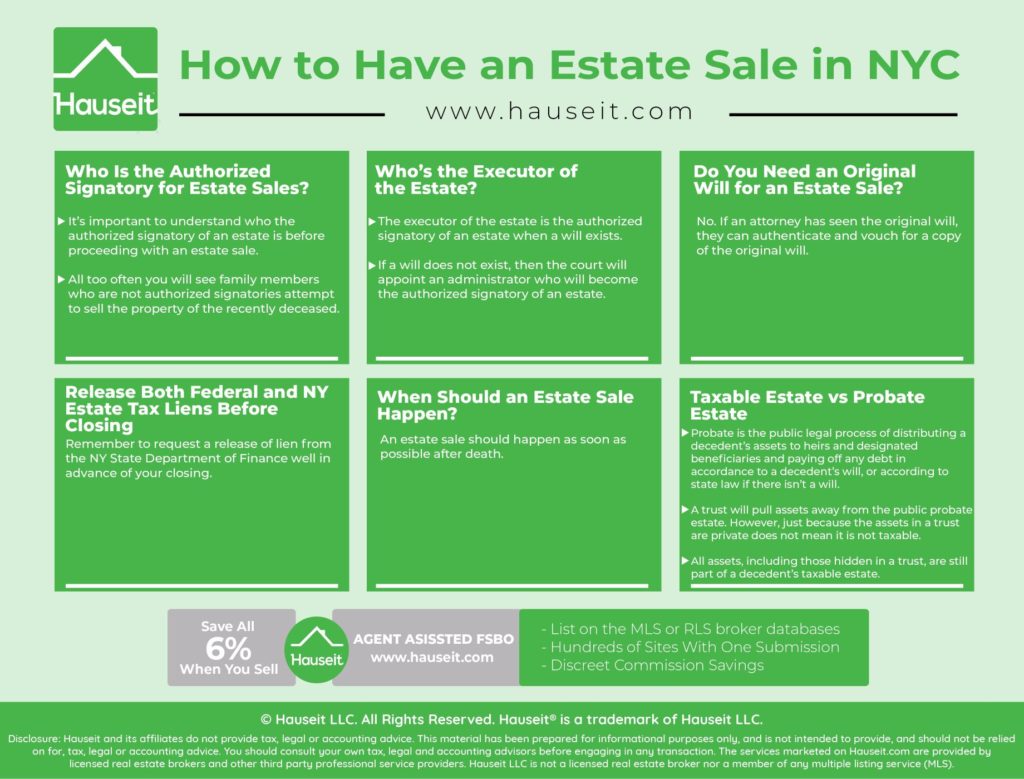

Who Is the Authorized Signatory for Estate Sales?

Anyone over 18 can sign binding documents on their own behalf. But what about the recently deceased? It’s important to understand who the authorized signatory of an estate is before proceeding with an estate sale. All too often you will see family members who are not authorized signatories attempt to sell the property of the recently deceased. This can waste time and cause significant delays in the NYC closing process.

Who’s the Executor of the Estate?

The authorized signatory for a recently deceased individual’s estate will vary depending on whether a testamentary device (i.e. a will) exists.

If a will exists and is deemed authentic, then the person appointed in the will to handle the estate becomes the executor of the estate. The executor of the estate is the authorized signatory of an estate when a will exists.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Process of Appointing an Executor or Administrator for Estate Sales

The first step for family members to take is to get a death certificate. The NYC Health Department issues death certificates for all people who die within the five boroughs of New York City. You can order Death Certificates online, but please note that requests can take 3-4 weeks to be processed.

Where to Present It

If the decedent left a will, this will need to be presented at your local county’s Surrogate’s Court (i.e. Probate Court). The court will decide whether the will is testamentary or not (i.e. whether it is authentic).

If the will is deemed to be authentic, then the person appointed in the will to manage the affairs and estate of the decedent becomes the executor of the estate. The role of the executor is simply execute the plan laid out in the will. The executor will be responsible for filling out all of the paperwork and can have liability of not executing the plan according to the will.

If the decedent died intestate, meaning that they did not leave behind a will, then the Surrogate’s Court will decide who will manage the estate sale and the affairs of the decedent. This court appointed individual is called the administrator of the estate.

The executor or administrator does not necessarily have to be an heir of the decedent.

Often times you will see lawyers or other non-family members who are executors or administrators of estates.

Do You Need an Original Will for an Estate Sale?

No. If an attorney has seen the original will, they can authenticate and vouch for a copy of the original will. This copy is called an attorney certified will, which essentially is a photocopy of the original will with the attorney’s signature certifying that all parties can rely on this photocopy as the original will.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Minimize Closing Costs for an Estate Sale of Real Estate

The single largest closing cost for estate sales is the typical real estate commission of 6% of the sale price. On the average $2 million home in NYC, that equates to $120,000 payable at closing.

More Options for Estate Sellers Today

Fortunately, there are more options these days to maximize the proceeds of an estate sale.

If you are the executor of an estate and you have time to show the property yourself, you can sell your home through an Agent Assisted FSBO, more commonly known as a flat fee MLS listing. This option enables you to save all 6% in broker commissions if you find a direct buyer while still enabling you to engage buyers’ agents.

This option may work best for executors who are also heirs of the estate and therefore most incentivized to maximize the proceeds from an estate sale.

If you don’t have the time or enough incentive to show the property yourself, you can still maximize your estate sale proceeds through a 1% for Full Service listing. You can save 50% or more off of the traditional 6% broker commission while having an experienced local real estate agent handle the entire estate sale process.

This option may work best for executors who are not heirs of the estate or court appointed administrators. They will be able to fulfill their fiduciary duty to maximize the proceeds from an estate sale, while not going out of their way to show the property and handle the sale themselves.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Release Both Federal and NY Estate Tax Liens Before Closing

Many people don’t realize that New York also has an estate tax.

Even though NY has roughly matched the federal estate tax exemption amount prior to the Tax Cuts and Jobs Act of 2018, it is unclear whether NY will match new, doubled federal estate tax exemption amount.

As a result, please remember to request and receive a release of lien from the NY State Department of Finance well in advance of your closing.

Buyers will need to make sure liens are released for both federal and NY estate tax or else the buyer could be stuck with any estate tax owed.

It’s interesting to note that the IRS used to send IRS agents to real estate closings to swap documents and hand over lien releases.

You’ll want to be careful with estate sales involving co op apartments because some older, outdated co op closing checklists require a federal estate tax lien waiver notice. This can be a problem as the IRS generally today will not respond if you do not owe an estate tax bill. This can hold up closing and is something that should be explained and addressed as early in the process as possible.

When Should an Estate Sale Happen?

An estate sale should happen as soon as possible after death.

If real estate is sold within one year of death, the IRS typically assumes the sale price is the full market value for the calculation of the estate tax.1 If the property is sold more than a year after death, an appraisal will need to be done to establish the value at the time of death. This is called a date of death appraisal.

For example, if the decedent passed away in 2000 but the heirs only got around to selling the decedent’s property in 2018, a date of death appraisal will need to be done. The appraiser will do historical analysis to determine what the real estate market was like in the year 2000.

1Remember that the assets of a decedent are subject to a step up in basis at death. That means the cost basis is stepped up to full market value at death, and passed onto heirs at full market value. That theoretically means the heirs would not be subject to any capital gains tax on any appreciation of the asset during the lifetime of the decedent. For real estate, the advantage can be huge as investment properties which have been depreciated also enjoy this step up in basis.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Taxable Estate vs Probate Estate

Probate is the public legal process of distributing a decedent’s assets to heirs and designated beneficiaries and paying off any debt in accordance to a decedent’s will, or according to state law if there isn’t a will.

Because probate is a public process, it can be challenged by someone who wishes to dispute some aspect of the will or the distribution of assets.

As a result, many people who wish to avoid potential disputes around their estate after passing away will set up a trust to keep assets private.

A trust will pull assets away from the public probate estate.

However, just because the assets in a trust are private does not mean it is not taxable. All assets, including those hidden in a trust, are still part of a decedent’s taxable estate.

There are two main types of trusts, irrevocable trusts and revocable trusts. An irrevocable trust can’t be taken apart or altered after you create it. However, you can move assets in and out of a revocable trust while you are still alive.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

Thanks for the tip about considering who the executor is when having an estate sale. It would be smart to consider this in advance so that everything is squared away. I want to have an estate sale, so I’ll have to consider the executor of the will first.

As an agent, you need to know you’re dealing w/ the right person, which is the executor of estate (if will), or if no will then the administrator of the estate. So you don’t waste time. Executor empowered to execute the plan of the estate, and they have legal power to sign.

Need death certificate. If multiple owners? Is it estate sale or not? Maybe. If married couple, tenants in the entirety, joint tenants with rights of survivorship, that’s all you need. Automatically the surviving co-tenant becomes the owner. This trumps even the will. Death certificate and affidavit.

If tenants in common, then have to do more. Need letters testamentary issued by surrogate court, letter gives power to executor to sign exclusive listing agreement.

Coops may want to see more than title companies. Want copy of will. Make sure no estate tax due. Release of lien from NY State. Federal need to be addressed too. Affidavit of domicile at death.

Most probates are pretty straightforward in reality. Get info upfront so you don’t waste time.

Where was Power of Attorney executed? Out of state POA? That’s not going to work on your NY transaction. Needs to be done right, have original etc. POA only works to the extent someone is still alive …

Moment someone dies, POA goes away and you have to work with estate regime.

On buyer side you need to work with title company, to make sure it’s all clear. Don’t want heirs come out of woodwork.

Release of lien, to make sure no estate tax on property, that can really delay or throw off process.

Form 18-17, that’s the NY estate tax lien form. Depends on value of estate, you may or may not need a release from federal government.

Remember the executor doesn’t need to be a relative or heir. It could be a lawyer or someone institutional. Executor has the power to bind the estate.