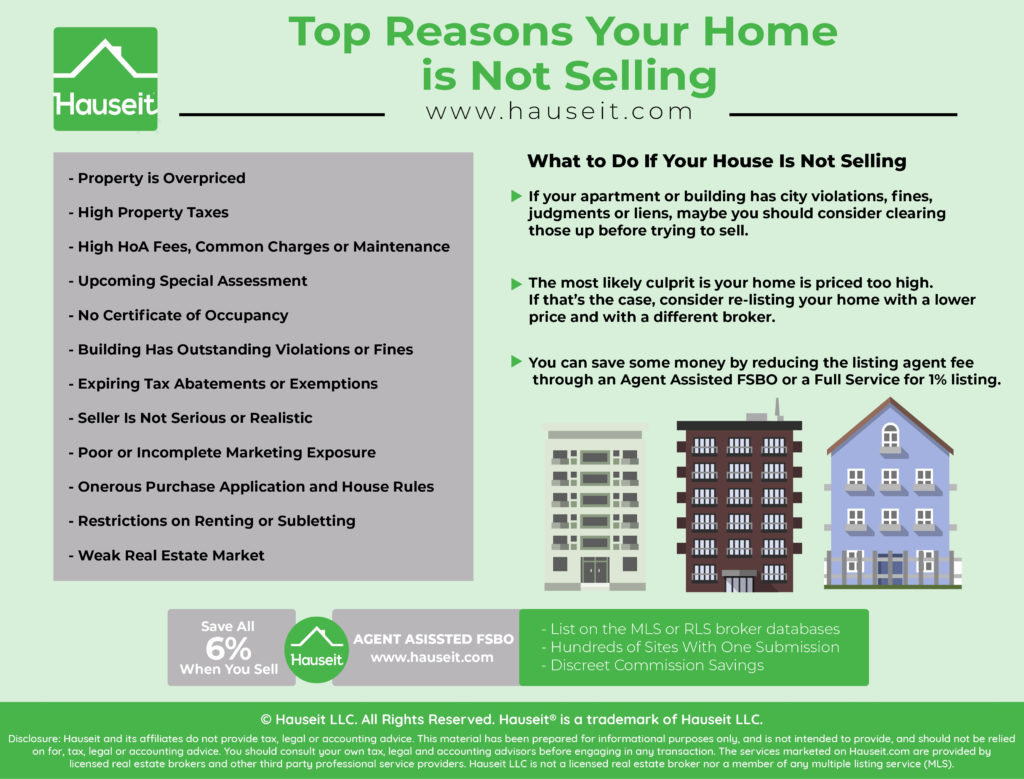

The top reasons your home is not selling include being way overpriced, having high monthly running costs, upcoming special assessments, not having a Certificate of Occupancy, having city violations, fines, judgments or liens against the property, onerous house rules or application process, restrictions against rentals and incomplete marketing exposure. We’ll talk about these potential issues and more in the following article, as well as what to do if your house is not selling.

Table of Contents:

The most common reason your home is not selling is because it’s priced way too high vs comps in your building or neighborhood. This leads buyers and their agents to believe that you are either not serious about selling, or that you have completely unrealistic expectations about what your home is worth.

Either impression is extremely bad for your prospects of even getting an offer because most buyers will not want to waste time submitting a lowball offer and negotiating with someone who isn’t serious or realistic.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

One of the most frequent reasons houses don’t sell is high property taxes and assessments by the local government. This situation is unfortunately out of your hands in most cases, as some states and municipalities simply tax and spend much more than some other jurisdictions.

High property taxes are even worse after the 2018 Tax Cuts and Jobs Act (TCJA) restricted State and Local Tax (SALT) deductions to $10,000, meaning many home owners with expensive to maintain properties are out of luck.

Perhaps ultimately this is a good thing as the federal government won’t be effectively subsidizing high tax states and encouraging their high tax, high spend behaviors. Changes in the tax code as a result of the TCJA have also helped buyers think about whether it makes sense to have a crazy expensive to maintain home. After all, you won’t be able to write any of that off, so does it really make sense at the end of the day?

High monthly carrying costs are a prime reason why your home isn’t selling, and one of the biggest components of monthly carrying costs are Homeowner Association (HoA) dues, condo common charges or co-op maintenance fees.

High fees from your HoA association, condo board or co-op board can be a sign of mismanagement, negligence or even fraud on the part of building management and board members.

After all, if a comparable building has a budget of $100,000 per year, why would someone want to own an apartment in a building with a budget of $200,000? Does it somehow cost twice as much to run one building vs the other?

HoA associations and condo/co-op boards that don’t raise monthly fees are a good sign that management is responsible, frugal and fiscally prudent. However, a condo or co-op board that has been consistently raising common charges or maintenance year after year could mean a passive board that has no control over costs and what the managing agent is doing.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

One reason why an apartment might not be selling is because of a major, upcoming special assessment that is about to be levied. Buyers typically find out about upcoming special assessments during the contract review and due diligence stage. It’s at this stage that the buyer’s attorney will study the building’s financial statements and board meeting minutes for clues on whether a big assessment might be coming up.

An attorney might also send a co-op questionnaire to the building’s managing agent, and if the buyer is financing the bank might send a questionnaire of their own. One of the questions on the questionnaire will undoubtedly be whether the managing agent knows about any upcoming special assessments.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

One potential reason your home is not selling is because your building doesn’t have a Certificate of Occupancy (CO), or because it only has a Temporary Certificate of Occupancy (TCO) vs a Permanent Certificate of Occupancy (PCO).

Remember, in New York and many other states, a building that doesn’t have a Certificate of Occupancy means that it’s not legally habitable, which technically means any inhabitants can be kicked out by the city at will.

Very frequently, a building might have a TCO instead of a PCO. A TCO is good for 90 days and must be continuously rolled over until a the building can get a PCO. You’ll frequently see this situation with new construction buildings that haven’t had time to get a Permanent Certificate of Occupancy yet.

Even though a TCO isn’t the end of the world, you should be aware that some banks may not agree to finance a purchase in a building without a PCO in place. As a result, buyers will want clarity on exactly when a PCO will be received, and how much it will cost to do so.

The most common reasons houses don’t sell often come down to outstanding city violations and fines by various government agencies, such as New York’s Department of Buildings (DOB).

If your building has recently failed a Local Law 11 inspection, this violation will show up when the buyer’s attorney searches the DOB website. Similarly, if the elevator in your building was recently re-fitted but your contractor never bothered to file or close out a permit, then you’ll have a violation as well that shows up on the DOB website.

Even worse, if your specific unit has outstanding city fines or violations, perhaps because you didn’t properly close out a permit when you did renovations in your apartment years ago, buyers will be even more hesitant to touch your property. In fact, most contracts stipulate that units must be delivered with a title that is free and clear of liens, judgments, violations etc.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

A common reason for property not selling even in a hot market is due to imminently expiring tax abatements, exemptions and other incentives on the property. For example, condos in NYC with a soon to expire 421g tax abatement, a 421g tax abatement or a J51 tax abatement will be viewed less favorably because buyers know that increased property taxes are on the horizon.

Buyers and especially their agents will generally be savvy enough to notice that a tax incentive is in place (most public real estate search websites will prominently display this) and will know how to determine when the tax incentive expires.

The reason your home is not selling may well be you. Are you hearing crickets on your listing? If so, it’s probably because you’ve priced your property way too high.

Take a hard look at comps in your building and your neighborhood. Are there any similar sized units for sale in your building? How about your block or neighborhood? If they are priced say at $1,000,000 and you are priced at $1,500,000, then it’s obvious that your property is dramatically overpriced. It’s no wonder that buyers won’t even bother reaching out to you in this case.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

One of the most common reasons why homes don’t sell is because of incomplete marketing exposure. This problem is most common for those who try to sell For Sale By Owner (FSBO) without listing their property in their local MLS. Unfortunately for these well intentioned FSBO sellers, not having MLS exposure effectively means their property is off market and unavailable to buyers’ agents who represent 90% of all home buyers.

What do most of these FSBO sellers do? They stick a “For Sale By Owner” yard sign in their yard and post a few amateur photos of their home on Craigslist, Zillow or whichever other site they can think of. To say this is a haphazard and incomplete method to market your home doesn’t even begin to describe the problem.

Think about it. No matter how popular one website is, you by default will be missing out on other buyers if you only list your home on that website. The same logic applies if you manage to list your property on two or three different websites. Unfortunately for FSBO sellers, there are hundreds of real estate search websites out there, and the most important place to list (the MLS) is completely off limits to non-brokers.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

If you own a co-op apartment, then the reason that your home is not selling could be because of your building’s extremely onerous co-op board approval process, purchase application and co-op house rules.

Just because you own a condo or condop apartment doesn’t mean you’re off the hook either. Many condos and condops have purchase applications of their own, some of which will rival those of co-ops in complexity, intrusiveness and difficulty. However, condo boards don’t have the right of approval, only the right of first refusal which makes the process it bit more bearable when buying a condo.

Most co-op buildings will restrict rentals in some shape or form. Keep in mind that renting out your co-op apartment is called subletting, because technically shareholder owners of co-op apartments are tenants themselves.

As a result, investors and really anyone who might need to move and rent out their apartment in the near future won’t be interested in buying a co-op.

Keep in mind that some condos will have restrictions as well on rentals, as hard to believe as that may sound. There are plenty of condo boards in NYC who think and act like co-op boards. Buyers should avoid these types of buildings like the plague.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

One of the most common reasons real estate agents gave in 2018 for the question of why isn’t my house selling is the weak real estate market, as evidenced by the plethora of media reports about the state of housing market nationally.

In 2019, the market has improved but is still relatively weak, especially in pricey metropolitan areas like NYC where the luxury condo market has taken an especially hard hit. Even though mortgage rates have moderated somewhat as of late, we predict the housing market to remain soft for the next year or two.

If your house is not selling, carefully consider which of the reasons above is the culprit for your inability to sell your home.

The most likely culprit is your home is priced too high. If that’s the case, consider re-listing your home with a lower price and with a different broker. You can save some money by reducing the listing agent fee through an Agent Assisted FSBO or a Full Service for 1% listing.

If your property has high monthly taxes, common charges, or maintenance fees, consider lowering your price to compensate buyers for your home’s high running costs. Everything has a price. If you lower your price enough, buyers will most certainly appear.

If your apartment or building has city violations, fines, judgments or liens, maybe you should consider clearing those up before trying to sell. Otherwise, you’re bound to run into a wall every time during the buyer due diligence period.

Pretty much any other reason such as having an onerous board approval process, restrictions on renting or a weak real estate market can be solved by lowering the price.

Lastly, if the reason that your home is not selling is because of incomplete marketing exposure, you can easily fix this by signing up for an Agent Assisted FSBO so your home can be properly marketed on your local MLS and all relevant public websites.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.