Knowing how to download and read your NYC property tax bills is an important skill for existing homeowners and prospective purchasers.

As a homeowner, you should review your NYC property tax bill regularly to make sure you’re receiving any abatements you may qualify for, such as the co-op and condo property tax abatement or the Senior Citizen Homeowners’ Exemption.

As a buyer, reviewing property tax bills is an easy way to verify the accuracy of tax figures on listings. Some listings may advertise property tax figures based on tax abatements which are close to expiring or which you might not qualify for.

Click on the sections below for a step-by-step tutorial on how to look up NYC property taxes online and how to analyze a NYC property tax bill.

This guide is geared towards condos and houses since individual unit owners pay taxes directly to NYC. Co-op property taxes are paid directly by the building on behalf of unit owners. Therefore, co-op tax bills aren’t particularly useful since they reflect the balance for an entire building.

Buying, selling or renting in NYC? Learn how to save with Hauseit.

Table of Contents:

How to look up a NYC property tax bill online

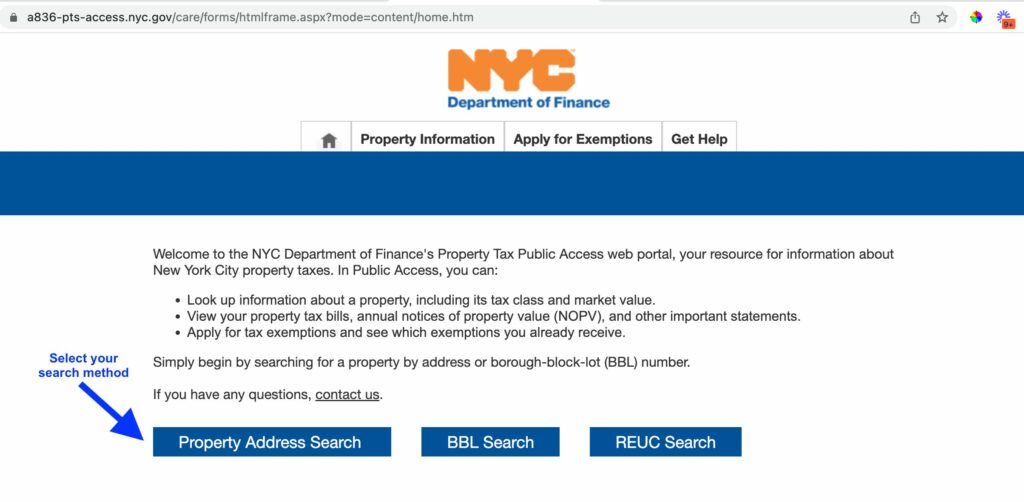

All NYC property tax bills are publicly accessible on the NYC Department of Finance website. Using this page, you can search by address or BBL (Borough-Block-Lot) to look up any home’s property tax bills and account history.

Every NYC homeowner’s name and mailing address is a matter of public record which is accessible to anyone on the internet.

Start by selecting whether you’d like to search by address or BBL:

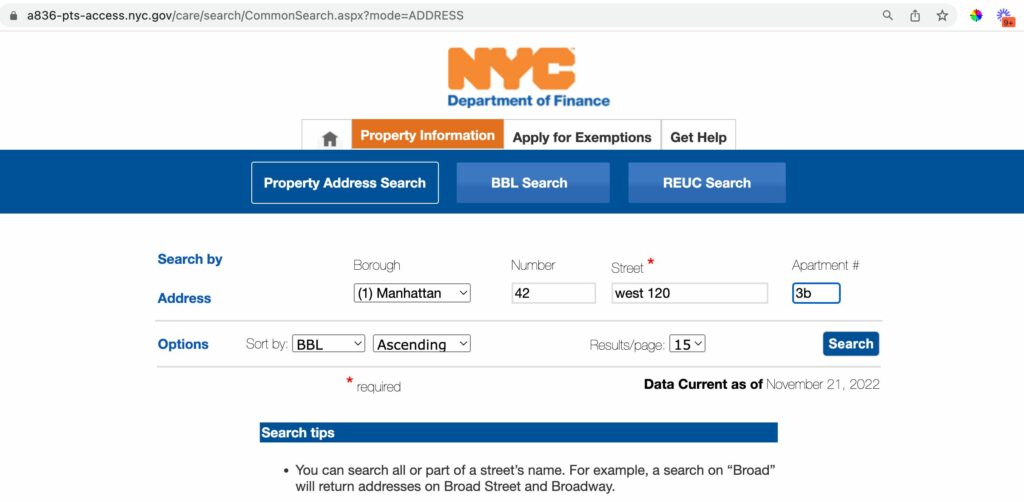

Consider the following tips if you’re searching by address:

-

Omit address ordinals (e.g. 21st Street = 21 Street, 32nd Road = 32 Road, etc.)

-

Spell out directionals (e.g. “North” instead of “N”, “South” instead of “S”, etc.)

-

Include dashes in street numbers (e.g. 32-53 33rd Street instead of 3253 33rd Street)

-

Do not include Apt. or # in the “Apartment #” field

Here are a few examples:

-

Search query: 3253 33 | Actual address: 32-53 33rd Street

-

Search query: 112-01 Queens 11L | Actual address: 112-01 Queens Boulevard #11L

-

Search query: 42 West 120 3B | Actual address: 42 West 120th Street #3B

Here is an example of how to correctly search for the property tax records pertaining to 42 West 120th Street #3B in South Harlem:

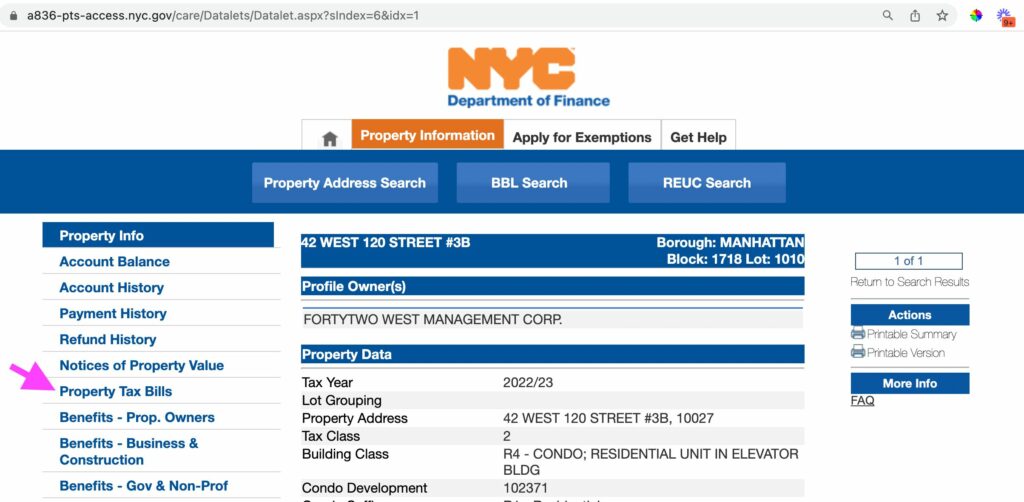

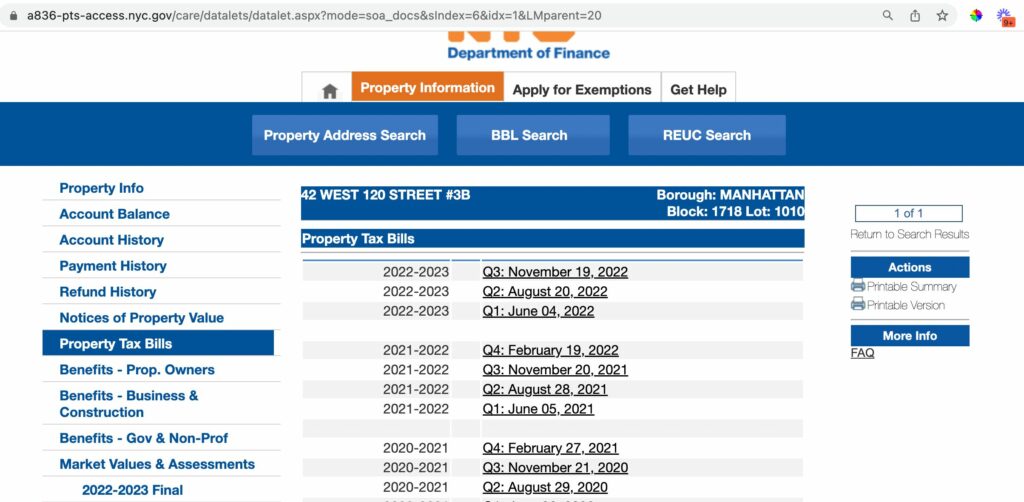

Click ‘Property Tax Bills’ on the left side to access the property’s account statements:

You can now view and download all historical property tax bills for the property:

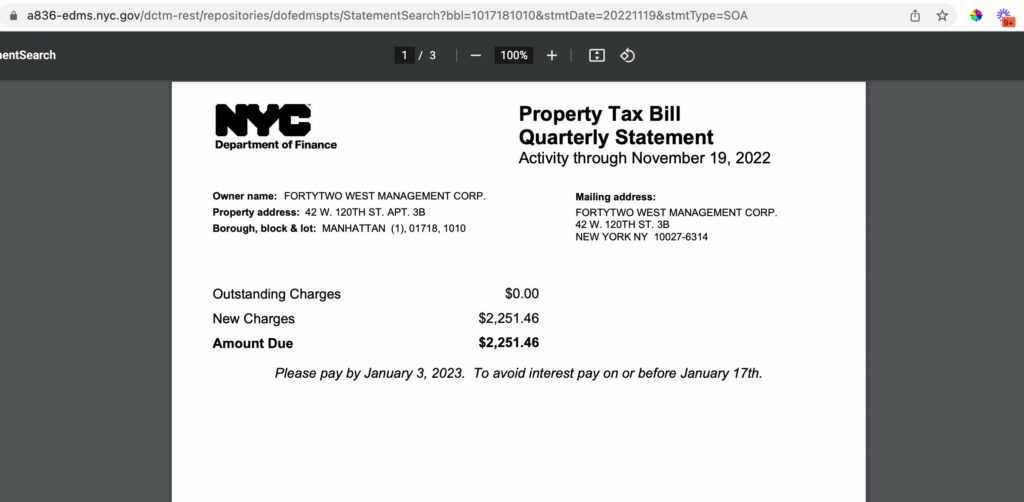

Click on any date to access the property tax bill. You’ll see a cover page which discloses the owner name, owner mailing address, BBL and the balance as of the statement date:

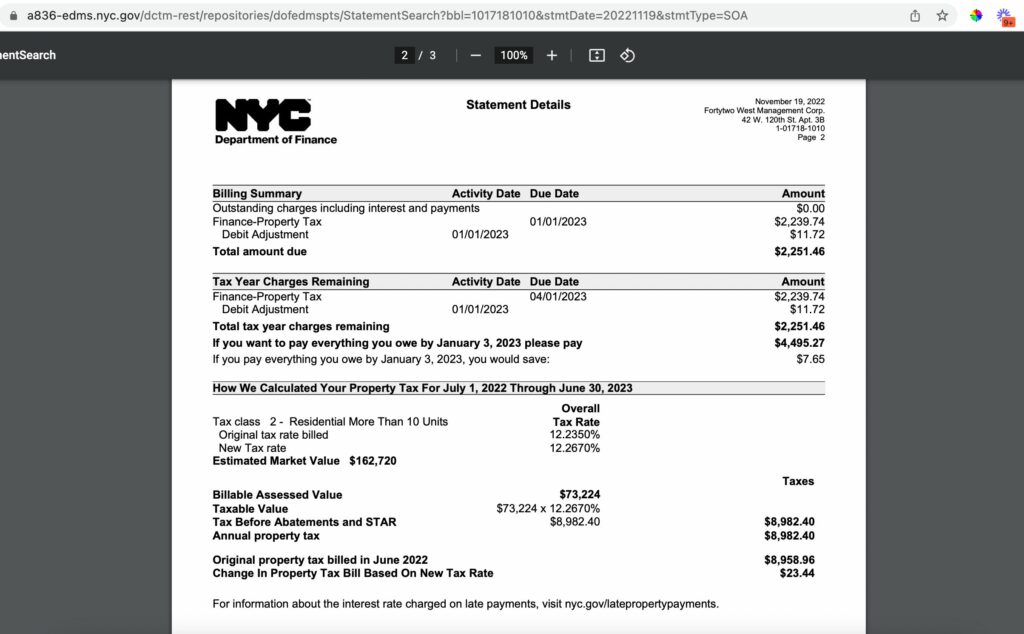

Scroll down further to view the actual property tax bill calculation:

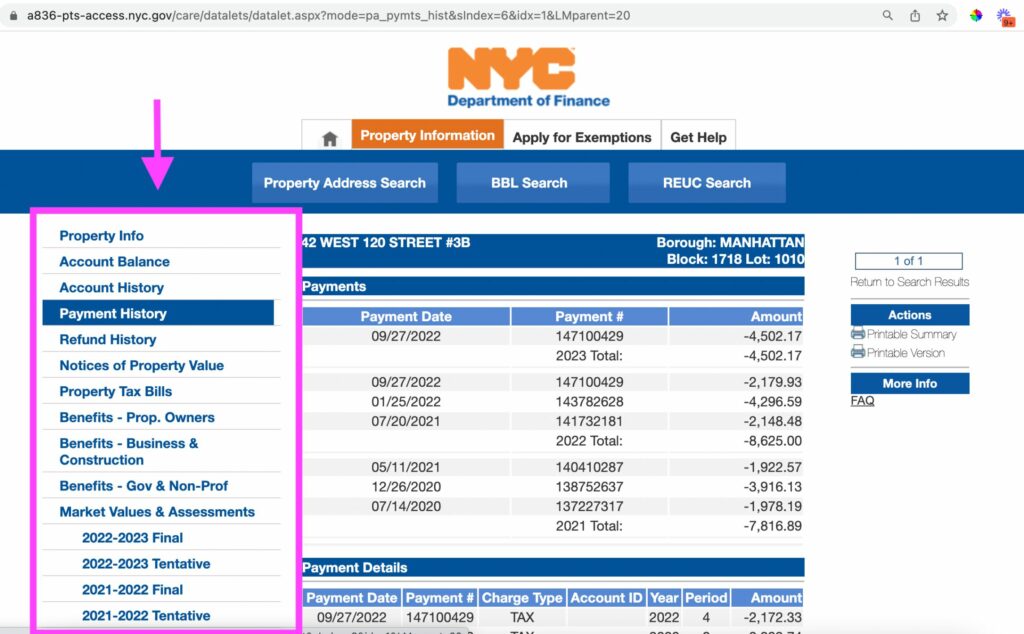

You can also access other information such as the property’s Payment History using the menu bar on the left side of the Department of Finance Website:

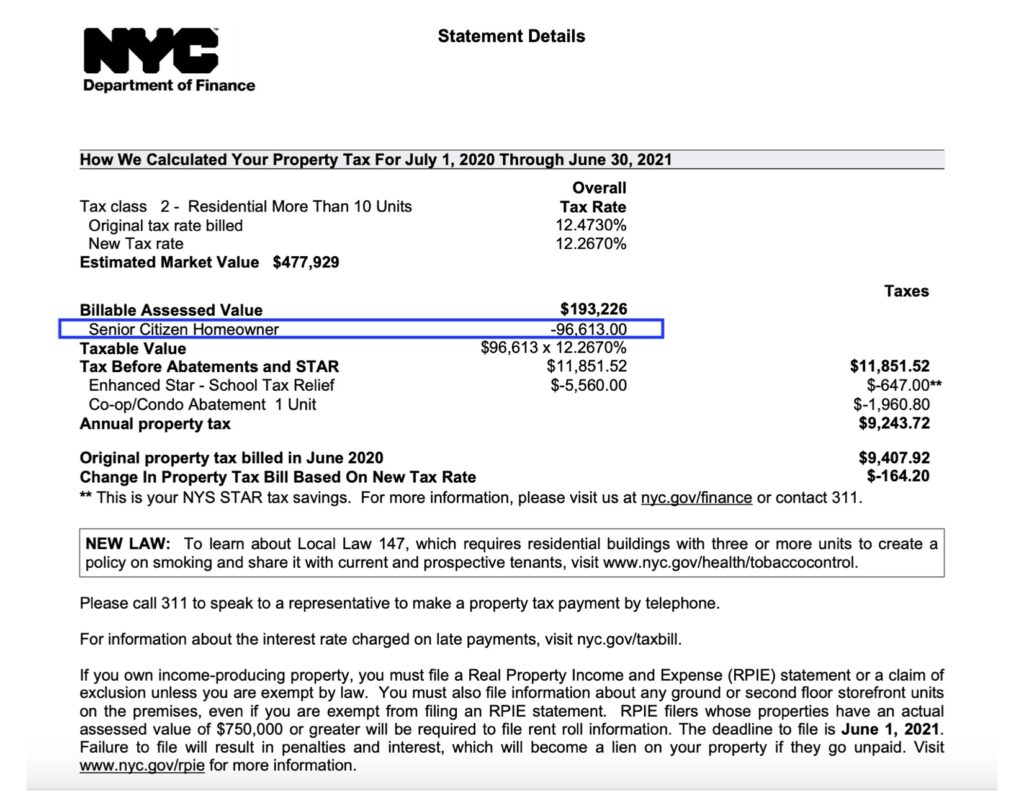

The annual property tax is calculated by multiplying the ‘Billable Assessed Value’ by the Tax Rate.

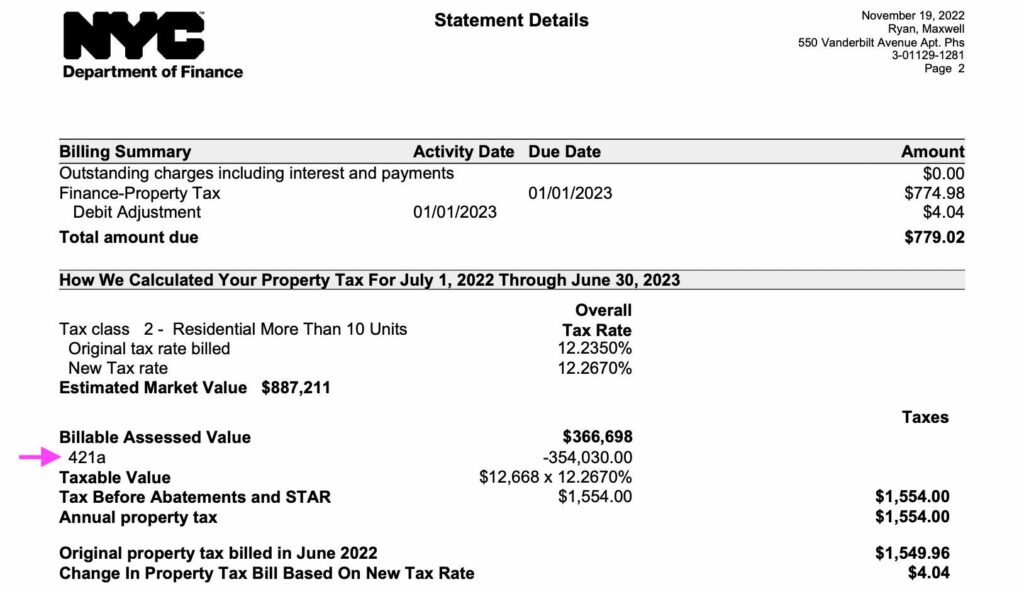

Certain tax benefits such as the 421a tax abatement lower the amount of tax payable by reducing the Billable Assessed Value, as shown below:

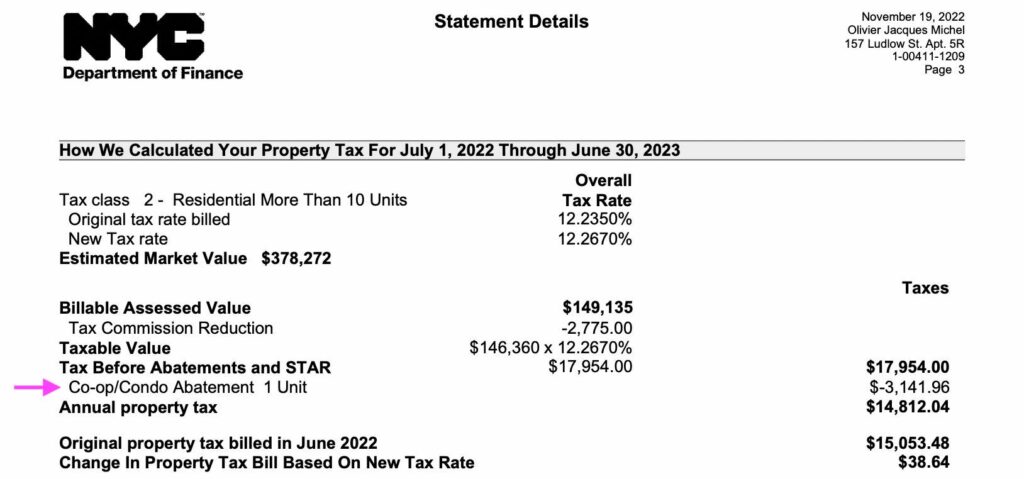

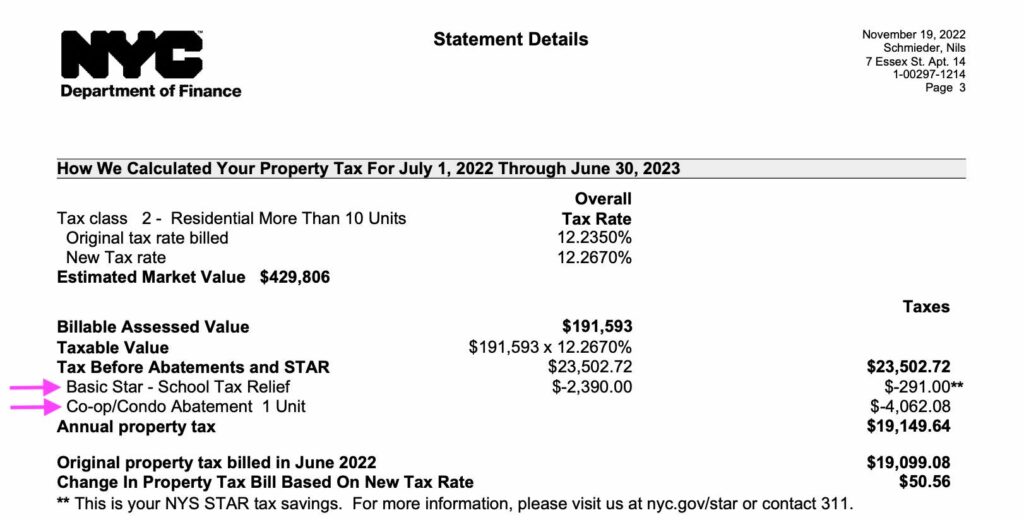

Other tax benefits such as the NYC Cooperative and Condominium Property Tax Abatement decrease property taxes on a dollar for dollar basis, as shown below:

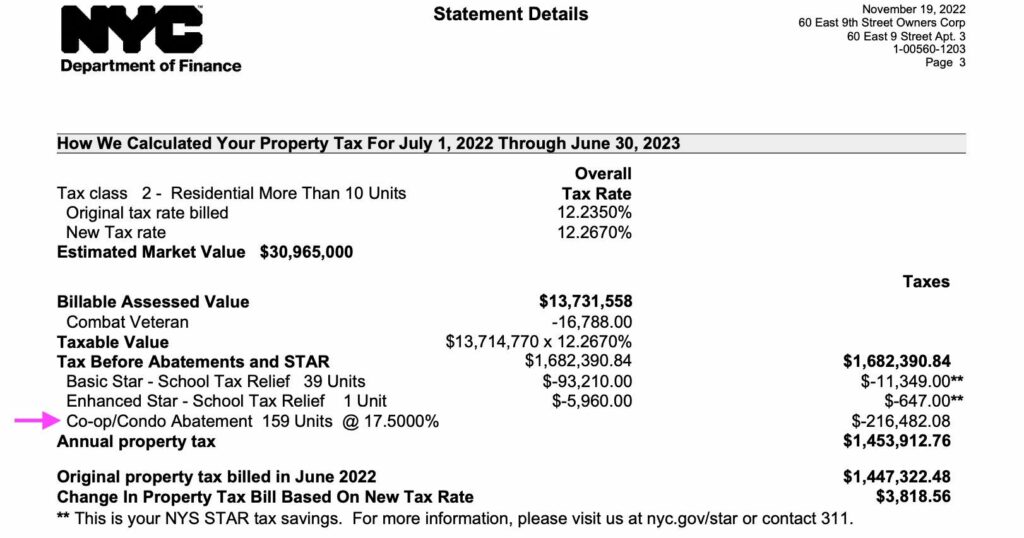

The coop condo tax abatement reduces annual property taxes by 17.50% to 28.10% for qualifying homeowners. The exact percentage savings is based on a sliding scale according to the ‘Average Assessed Value’ of the unit.

Additional property tax benefit programs in NYC include 421g, J-51, Basic STAR, Enhanced STAR and the Senior Citizen Homeowners’ Exemption (SCHE).

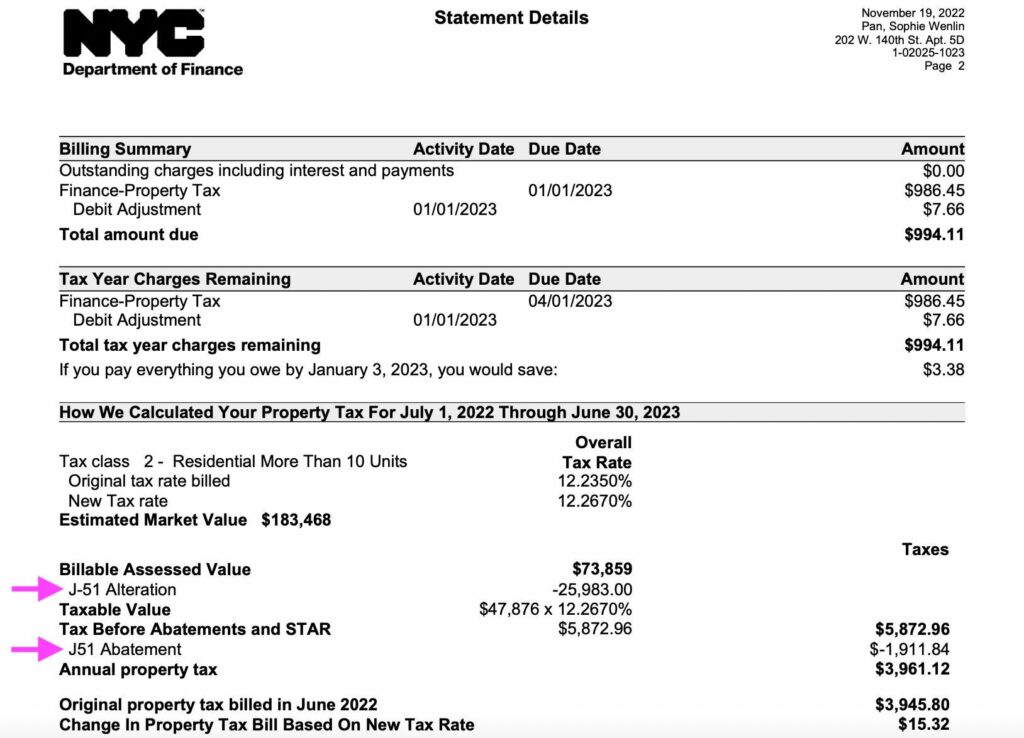

Interestingly, the J-51 abatement consists of both a tax exemption that freezes the assessed value at the level before construction began, as well as a tax abatement that decreases property taxes on a dollar for dollar basis. Therefore, J-51 shows up twice on the property tax bill:

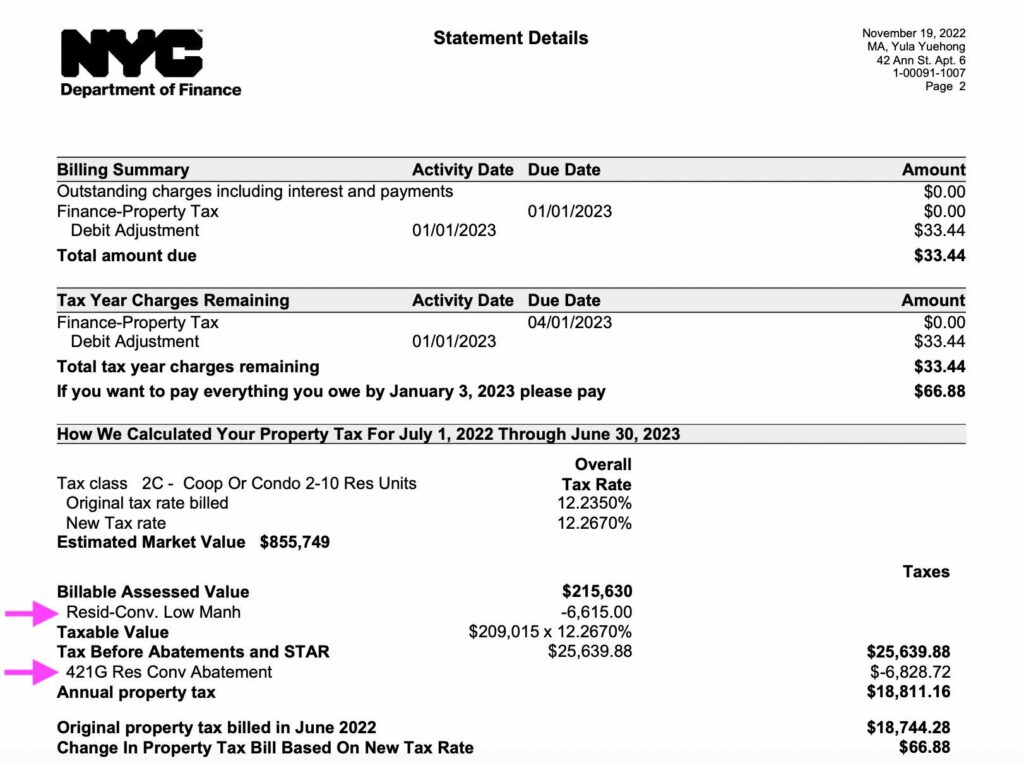

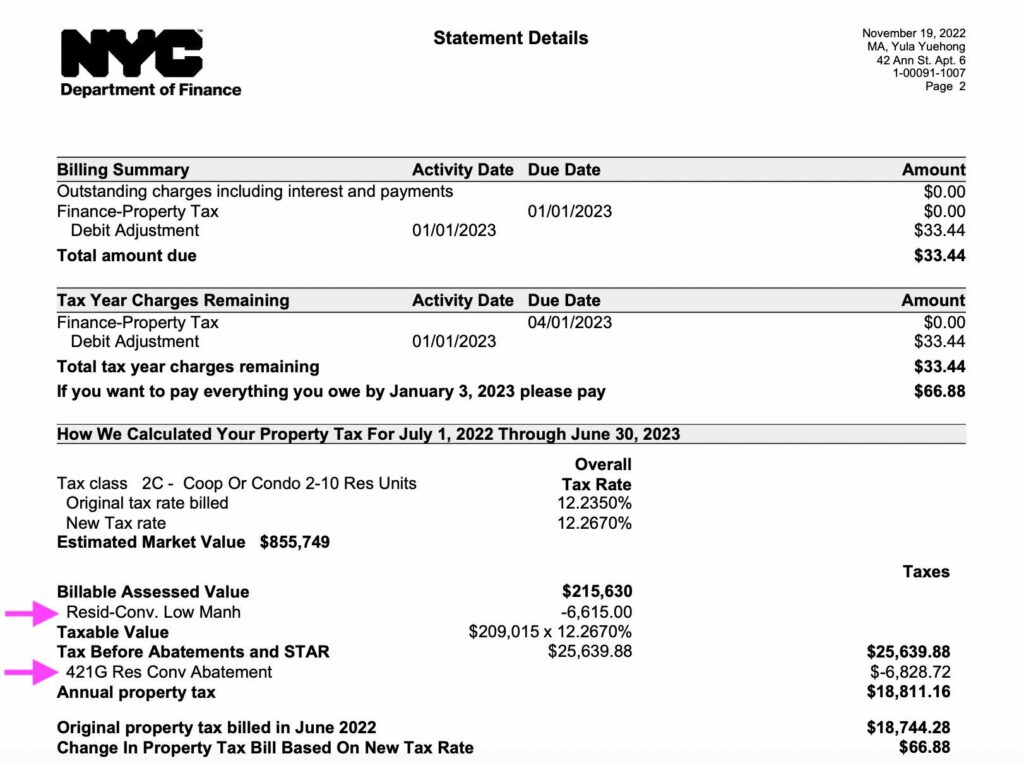

The 421g abatement also shows up in two places on a NYC property tax bill:

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Sample NYC property tax bill

Here is a simple NYC property tax bill for a Lower East Side condo located at 7 Essex Street. The statement indicates that the current owner is receiving both the co-op condo tax abatement as well as Basic STAR:

Here is a sample NYC property tax bill for a condo at 42 Ann Street in Manhattan’s Financial District. The statement reveals that the building is currently receiving tax benefits under the 421g tax abatement program:

How to look up a NYC co-op property tax bill

NYC co-op tax bills aren’t particularly useful to analyze since they aren’t broken out individually by unit. Instead, co-op corporations pay property taxes directly to NYC on behalf of all unit owners.

Here is a sample co-op property tax bill for 60 East 9th Street (The Hamilton), a large post-war co-op in Greenwich Village:

As you can see, co-ops do qualify for some property tax relief such as the coop condo tax abatement. However, co-op owners don’t usually pocket the discount directly since most co-ops capture this tax abatement by levying an annual co-op tax abatement assessment.

Why should buyers review NYC property tax bills?

If you’re buying a home in NYC, it’s important to review the actual property tax bill so you can verify that the property tax figures on the listing are accurate. Property tax figures on listings can be incorrect or misleading for several reasons:

-

Listings often have out-of-date or incorrect property tax figures.

-

Some listings may advertise property tax figures based on tax abatements which you might not qualify for.

-

A listing may show abated taxes even though the abatement is close to expiring or tapering off.

Always be sure to check the property tax bill before submitting an offer.

If a listing has been on the market for more than six months, odds are that both the monthly property taxes and common charges have increased. Listing agents rarely remember to update this information.

Moreover, it’s important to check the property tax bill to see if the monthly taxes stated on the listing reflects any abatements which you might not qualify for such as the condo coop tax abatement or the Senior Citizen Homeowners’ Exemption.

For example, if a condo’s listed property taxes are based on the coop condo tax abatement (which the current owner qualifies for) but you’re buying in an LLC, your actual tax bill will be higher since you won’t qualify for this abatement as the new owner.

Fortunately, you can easily calculate the un-abated taxes by referencing the property tax bill.

In the example below, the annual property tax is $12,471.76 when factoring in the coop condo tax abatement which the current owner is receiving:

If you don’t qualify for this abatement, your actual annual property tax bill will be $15,117.28. That’s an extra $220.56 each month.

Another reason that a listing’s property taxes might not be representative of what you’ll actually pay is if the current owner is receiving the Senior Citizen Homeowners’ Exemption.

Here’s an example property bill which shows that the current owner is receiving SCHE: